Getting pre-approved for a mortgage is a crucial step in the home-buying process. It gives you a clear idea of how much you can borrow and enhances your position as a buyer. Here’s a step-by-step guide to help you navigate the pre-approval process successfully.

Gather Your Financial Documents

Before applying for pre-approval, collect the necessary financial documents, which usually include:

- Proof of income (pay stubs, W-2s, tax returns)

- Proof of assets (bank statements, retirement accounts)

- Credit history (credit report)

- Employment verification (contact information for your employer)

Having these documents ready will streamline the application process and help your lender assess your financial situation accurately.

Check Your Credit Score

Your credit score plays a significant role in the mortgage pre-approval process. Obtain a copy of your credit report and review it for any errors or discrepancies. A higher credit score generally leads to better mortgage rates. If your score needs improvement, take steps to enhance it before applying for pre-approval.

Determine Your Budget

Calculate your budget to understand how much you can afford to borrow. Consider your income, expenses, and current debt obligations to determine a comfortable monthly mortgage payment. This budget will guide you in finding a home that fits your financial situation.

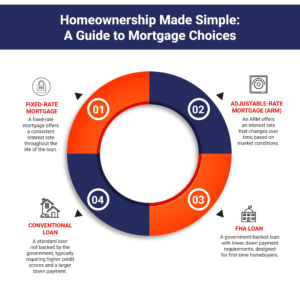

Research Lenders and Mortgage Options

Explore different lenders and mortgage options to find the best fit for your needs. Compare interest rates, loan terms, and fees to determine which lender offers the most favorable terms. Look for experienced real estate agents who can recommend reputable lenders and provide valuable insights into the mortgage process.

Complete the Pre-Approval Application

Once you’ve selected a lender, complete the pre-approval application. This will require you to provide detailed information about your financial situation, employment, and assets. Be honest and thorough in your responses to ensure an accurate assessment of your eligibility.

Submit Required Documentation

Along with your application, submit the financial documents you’ve gathered. The lender will review these documents to verify your income, assets, and creditworthiness. Ensure that all information is up-to-date and accurate to avoid delays in the approval process.

Receive Your Pre-Approval Letter

After evaluating your application and documents, the lender will provide a pre-approval letter if you meet their criteria. This letter indicates the maximum loan amount you’re eligible for and can be used to show sellers that you’re a serious buyer. Keep this letter handy as you begin your home search.

Review and Sign the Pre-Approval Agreement

Carefully review the pre-approval agreement to ensure you understand the terms and conditions. Once you’re satisfied, sign the agreement to finalize the pre-approval process. This agreement may include details about the loan amount, interest rate, and any conditions that must be met before closing.

Stay on Top of Your Financial Situation

Maintain your financial stability throughout the home-buying process. Avoid making large purchases or taking on new debt that could impact your credit score or financial situation. Keeping your finances in order will help ensure a smooth transition from pre-approval to closing.

Ready to Get Started on Your Home Buying Journey in Camp Hill?

Getting pre-approved mortgage is just the beginning of an exciting journey. If you’re ready to find a realtor and start exploring houses for sale in the Camp Hill, PA, area, Smith Top Team Realtors is here to help. Their team of top realtors is dedicated to guiding you through every step of the process, from listing your properties for sale to closing. Contact them today to get started and make your home-buying dreams a reality!