When buying a home, many buyers are familiar with the down payment, but few realize the significant costs associated with closing a deal. These are known as closing costs, and they can add up quickly. Understanding what they are and how to budget for them is crucial for anyone looking to buy a home.

What Are Closing Costs?

Closing costs refer to the fees and expenses that buyers and sellers incur when finalizing the sale of a property. These costs cover a wide range of services and are typically paid at the closing of the transaction, hence the name. While the exact amount can vary based on the location and price of the property, closing costs typically range from 2% to 5% of the home’s purchase price.

What’s Included in Closing Costs?

There are several fees involved in closing costs, each covering different aspects of the transaction process. Here are some of the most common ones:

- Loan-related fees: These include the application fee, underwriting fee, and points, which are fees paid upfront to reduce the interest rate.

- Title and escrow fees: Title insurance protects the buyer and lender from potential legal claims against the property. The escrow company charges a fee to handle the closing process.

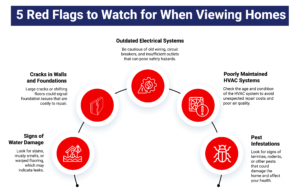

- Appraisal and inspection fees: These fees cover the cost of a home inspection and appraisal, ensuring the property’s value and condition meet the lender’s standards.

- Property taxes and homeowners insurance: Some buyers must prepay property taxes and homeowners insurance as part of the closing process.

- Attorney fees: In some areas, hiring an attorney is required to review contracts and oversee the legal aspects of closing.

- Recording and transfer taxes: These are state and local taxes associated with the property transfer and public record updates.

How to Budget for Closing Costs

The key to managing closing costs is proper planning. Knowing what to expect can help you avoid any last-minute surprises. Here are some tips for budgeting:

- Ask for a breakdown: Your lender is required to provide a Closing Disclosure that outlines all of the costs associated with closing. This form includes an itemized list of expenses so you can see exactly what you’ll need to pay at closing.

- Save early: Start setting aside money for closing costs as soon as you begin the home-buying process. It’s a good idea to save an additional 3% to 5% of the home’s purchase price to cover these fees.

- Negotiate with the seller: In some cases, you may be able to negotiate with the seller to cover part of the closing costs. This is often referred to as a seller concession, and it can help reduce your out-of-pocket expenses at closing.

- Shop for services: Some fees, like title insurance, can be negotiated or priced. Be sure to compare rates for things like title services, home inspections, and appraisals to get the best deal.

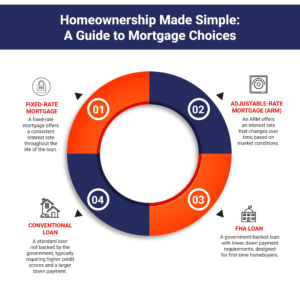

- Consider loan programs: Certain loan programs, like VA or FHA loans, may offer options that allow you to roll closing costs into your mortgage. Speak with your lender to find out if this is an option for you.

Let Us Help You With Your Real Estate Journey

If you’re looking to buy a home or sell your home in Camp Hill, PA, Smith Top Team Realtors is here to guide you every step of the way. We know that understanding closing costs is a key part of the home-buying process, and we’re committed to helping you plan ahead and make the best financial decisions. Our team of real estate experts will provide you with the support and knowledge you need to make informed choices. Whether you’re a first-time buyer or an experienced investor, we can help you navigate the complexities of the real estate market with ease.

Call us now to find a realtor who will provide expert guidance on your home-buying or selling journey in Camp Hill, PA!