Buying your first home? You’re most likely feeling excited, nervous, and a little confused.

You’ve found the perfect house and you absolutely love the neighborhood. All the amenities are close by; the neighbors are friendly, and commuting to work won’t be an issue.

The only problem is that there are some things you’d like to negotiate with the seller. The price is one of these things.

Except…you don’t know how.

Most first-time buyers assume that their realtor will do the negotiation for them. That’s only true to some extent. You need to first figure out what you want to negotiate with the seller before signing the deal.

While all of this depends on your requirements, there are certain things that should be bargained before taking the final step.

Let’s take a look at what you should negotiate before buying a house:

The Closing Costs

What catches first-time buyers off-guard are the closing costs. This is because they don’t realize that there are extra costs they have to pay when they sign the deal.

The closing costs depend on the value of the home or the amount you’re paying for the property. You’ll have to pay between 2% or 5%, depending.

But you can also negotiate with the seller and convince them to pay part of the closing costs or all of them.

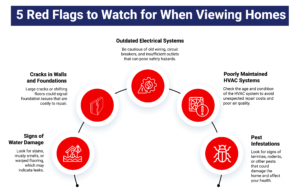

If some things need to be fixed, the seller should be willing to pay pay for them. Don’t take short end of the stick just because you feel you can get repairs done. You don’t know what else needs to be fixed so ask the seller to pay for the repairs.

Home Warranty

When purchasing a house, always ask for a home warranty. The warranty will pay for damages related to HVAC systems, plumbing, and broken furnishings. It’s good to get a home inspection done before you sign the deal. This way, you can find out what needs to be repaired and replaced.

The seller will pay for everything upfront so you’ll have to coordinate with them.

Flexibility on Closing Dates

Here’s the thing: if you’re living somewhere else and you’ve purchased a house, you can negotiate with the seller to buy out your current lease.

Most sellers are motivated to sell their home and won’t have a problem with adjusting the price to help you get out of a lease. This way, you can move into your new home right away, instead of waiting for a couple of months.

And last but not least, make sure to discuss your plans with your realtor before taking the final steps. They are there to guide you through the process so you have a stress-free experience buying your first home.

If you’re looking for a real estate agent in Mechanicsburg or Camp Hill, PA get in touch with Smith Top Team. We guarantee complete transparency and open communication at all times.

Our brokerage is run by father-son real-estate duo with collective experience of more than 40 years in the Mechanicsburg and Camp Hill real estate market.

Contact us for a free consultation.