When it comes to real estate investment, one factor that can significantly impact your profitability is the interest rate. Whether you’re a seasoned investor or a first-time buyer, understanding how interest rates affect your real estate investment is crucial for making informed decisions. Here’s how interest rates influence the real estate market and your investment outcomes.

How Interest Rates Affect Mortgage Payments

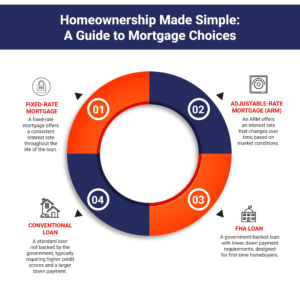

Interest rates play a pivotal role in determining how much you will pay monthly on a mortgage. The higher the interest rate, the higher your monthly payments will be. This can make owning a home or property more expensive, potentially reducing the amount of money you can borrow. For example, a 1% increase in interest rates could result in hundreds of dollars added to your monthly mortgage payment. This can affect your purchasing power when buying a home or investing in real estate. When interest rates rise, the same property may become less affordable, limiting the pool of potential buyers, which could influence property values.

The Impact on Property Prices

Interest rates also affect property prices. When interest rates rise, the cost of borrowing increases, which may cause demand for homes to slow down. With fewer buyers in the market, property values could decline. On the flip side, when interest rates are low, buyers have more purchasing power, which can drive demand and cause property prices to increase. In essence, interest rates can influence the real estate market, which in turn impacts the real estate investment you make. By understanding these trends, you can better navigate market changes and make strategic decisions about when to buy or sell.

The Cost of Financing and Long-Term Returns

For investors, the cost of financing plays a critical role in determining the long-term returns on your real estate investment. When interest rates are low, it is easier and cheaper to finance a property, which increases the potential return on investment (ROI). Conversely, high interest rates can reduce your ROI by making financing more expensive. As a result, timing your real estate investment can significantly impact the overall profitability of your venture. For example, securing a mortgage during a period of low interest rates could lead to substantial savings over the life of the loan, allowing for more cash flow or higher profits when you decide to sell.

How to Prepare for Changes in Interest Rates

While you can’t control interest rates, you can take steps to minimize their impact on your real estate investment. Working with experienced realtors and real estate experts can help you navigate these changes. They can provide guidance on market trends and interest rate forecasts, helping you time your investment decisions accordingly. For example, if interest rates are expected to rise, it may be wise to act quickly and secure financing before rates go up. Conversely, if rates are expected to fall, waiting to buy a home or invest in real estate might allow you to lock in more favorable terms.

Let Us Help You Navigate Your Real Estate Investment Journey

If you’re ready to invest in real estate or buy a home in Camp Hill, PA, Smith Top Team Realtors is here to help you navigate the complexities of the real estate market. We understand how crucial interest rates are to your real estate investment decisions, and we’re dedicated to helping you make the most informed choices. Our team of experienced real estate agents will guide you through every step of the process, from identifying the best properties to securing financing. We are here to ensure you get the most value out of your real estate investments.

Call us now to find a realtor who can help you achieve your real estate goals in Camp Hill, PA!