Deciding whether to rent or buy a home is a significant decision that depends on various personal and financial factors. Each option has its advantages and drawbacks, and understanding these can help you make an informed choice. Here’s a guide to help you decide what’s right for you in the context of renting vs buying.

Financial Considerations

Initial Costs

One of the primary differences between renting and buying is the initial cost. Renting will typically require a security deposit and the first month’s rent, which is significantly lower than the down payment and closing costs associated with buying a home. If you’re not financially prepared for the upfront costs of purchasing a home, renting may be the better option.

Monthly Payments

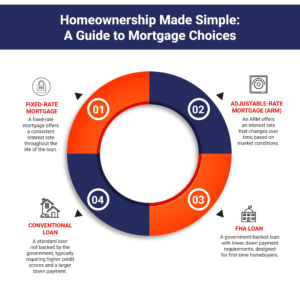

When you buy a home, your monthly mortgage payments contribute to building equity. In contrast, rent payments go to your landlord without any long-term financial benefit. However, mortgage payments can sometimes be higher than rent, especially in the short term. Evaluate your monthly budget and consider which option is more financially feasible for you.

Maintenance and Repairs

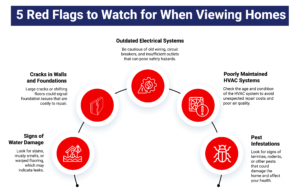

Homeowners are responsible for all maintenance and repair costs, which can add up over time. Renters, on the other hand, typically have these costs covered by their landlord. If you prefer a stress-free living situation with fewer unexpected expenses, renting might be more appealing.

Lifestyle Considerations

Stability vs. Flexibility

Buying a home offers stability and the freedom to customize your space. Homeownership is ideal if you plan to stay in one location for an extended period. On the other hand, renting provides flexibility. If you anticipate relocating for work or personal reasons in the near future, renting allows you to move without the hassle of selling a property.

Community and Lifestyle

Consider the community and lifestyle you want. If you’re looking to settle in a specific neighborhood, buying a home can provide a sense of permanence and belonging. However, if you prefer urban living or want to experience different neighborhoods, renting offers the flexibility to explore various communities without a long-term commitment. This decision between renting vs buying depends greatly on your lifestyle preferences and needs.

Market Considerations

Real Estate Market Trends

Understanding the real estate market is crucial when deciding between renting and buying. In a buyer’s market, where property prices are relatively low, buying might be a more advantageous option. Conversely, in a seller’s market with high property prices, renting could be more cost-effective. Research current market trends and consult with experienced real estate agents to make an informed decision.

Investment Potential

Buying a home can be a good investment, as property values tend to appreciate over time. Homeownership allows you to build equity, which can be a valuable financial asset. However, this investment comes with risks, including potential declines in property value. Renting does not offer the same investment potential but provides more financial predictability and flexibility.

Ready to decide between renting and buying? Let Smith Top Team Realtors assist you in navigating the real estate market in Camp Hill, PA. Our top realtors are committed to helping you make the best choice for your financial and lifestyle needs. Whether you want to explore houses for sale or find the perfect rental, our experienced real estate agents are here to guide you.

Contact us today to start your journey toward your ideal living situation.