If you’re looking to invest in real estate and purchase your first investment property, securing financing is a crucial step. Understanding how to obtain the right financing can set the stage for a successful investment and ensure you get the best return on your property. Here’s a guide on securing financing for your first investment property and making your real estate dreams a reality.

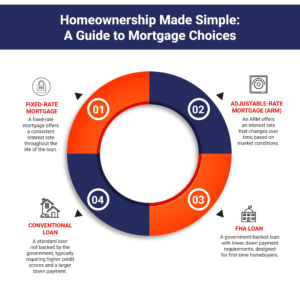

Understanding Your Financing Options

The first step in securing financing for an investment property is to understand the various options available. Several types of loans and financial products are designed specifically for real estate investors. Traditional loans, government-backed loans (like FHA or VA loans), and hard money loans are some of the most common options.

As a first-time investor, it’s important to consult with experienced realtors and real estate professionals who can help you determine the best loan type for your financial situation. Some loans are ideal for those with excellent credit, while others may be more suitable for those with less-than-perfect credit or higher-risk properties.

Review Your Credit Score

Before applying for financing, take a look at your credit score. Lenders often examine your credit score to determine your loan eligibility and interest rates. The higher your credit score, the better your chances of securing a low-interest loan for your investment property. If your score isn’t as high as you’d like, take steps to improve it before applying for financing.

It’s important to note that real estate investors often face higher interest rates than homebuyers due to the higher risk involved in investment properties. But, working with top real estate agents who have access to a network of lenders can help you find the best possible financing options.

Calculate Your Down Payment and Closing Costs

Most investment properties require a larger down payment than standard home loans, typically ranging from 15% to 25% of the property’s purchase price. As a first-time investor, it’s factoring this down payment into your budget is important. Additionally, you’ll need to account for closing costs, which can add another 2% to 5% of the purchase price.

Planning and saving for the down payment and closing costs is crucial for successfully obtaining financing for your investment property. Setting aside more than the minimum down payment is a good idea to avoid any surprises during the process.

Explore the Role of Rental Income

When considering financing for an investment property, keep in mind that rental income can play a significant role in securing your loan. Lenders often consider the potential rental income that a property could generate. If the property has a strong rental history or is located in a high-demand rental market, it can increase your chances of getting approved for a loan.

Work With a Real Estate Agent

The importance of working with an experienced realtor cannot be overstated when securing financing for an investment property. Local real estate agents have a deep understanding of the market and can connect you with lenders who specialize in investment properties. They can also help you find properties that meet your investment goals and budget, saving you time and effort in the process.

Let Us Help You Find Your First Investment Property

If you’re ready to invest in real estate and secure financing for your first investment property, we’re here to help. At Smith Top Team Realtors, we understand the ins and outs of the real estate market in Camp Hill, PA, and we are committed to helping you navigate the financing process. Our team of experienced realtors will provide you with the guidance and expertise you need to make informed decisions. We’re here to help you find the best financing options, negotiate favorable terms, and find the right investment property for your goals.

Call us now to find a realtor who can guide you through the process and help you succeed in the Camp Hill PA real estate market!