When it comes to buying a home or investing in real estate, real estate prices are one of the most crucial factors to consider. However, real estate prices are not just influenced by the property itself but also by the local economy. Understanding the impact of the local economy on real estate prices can help both buyers and investors make more informed decisions. From job growth to infrastructure development, the local economy can determine whether real estate prices are rising or falling in a particular area.

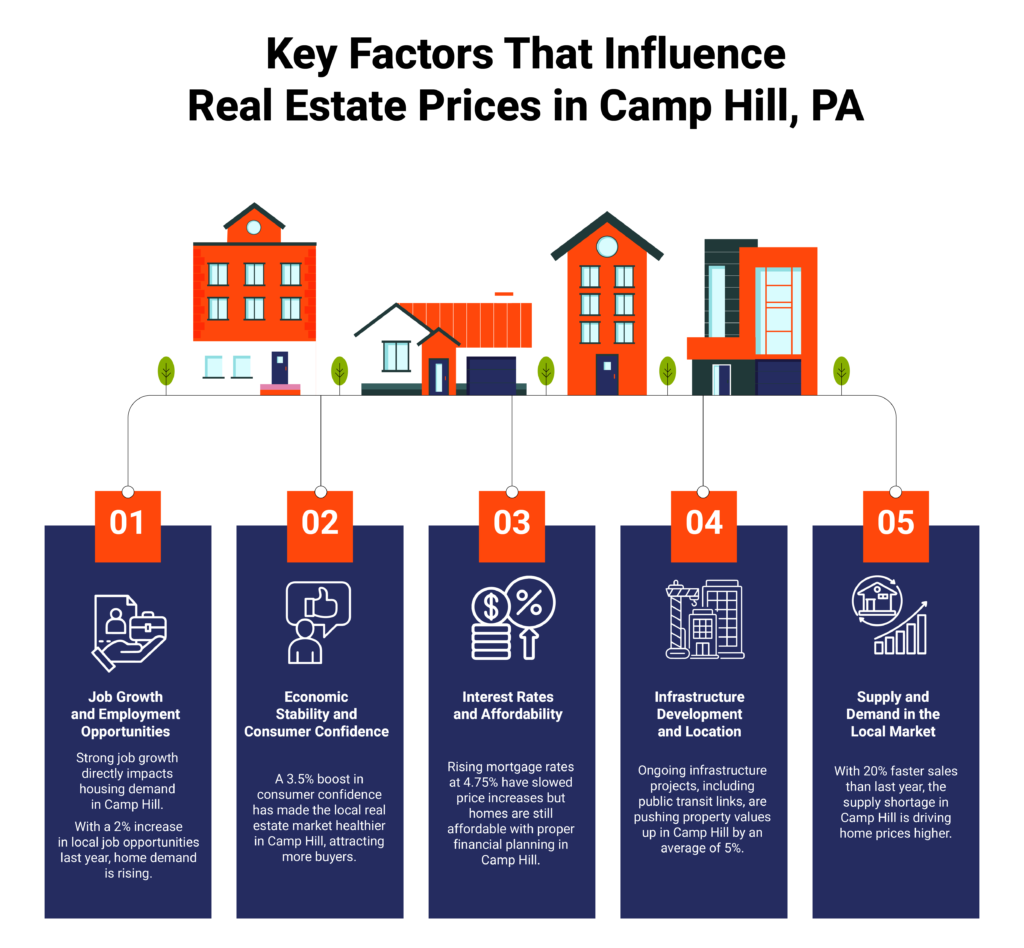

Job Growth and Employment Opportunities

One of the most significant factors that influences real estate prices is job growth. When a local economy is thriving and employment opportunities are abundant, it attracts more people to the area. As more people move to a region for work, the demand for housing increases, driving up real estate prices. Cities with a strong job market, such as those with a diverse economy or tech hubs, often experience a surge in real estate demand. For example, local real estate agents in Camp Hill, PA, can see significant price increases when companies expand or new employers move into the area.

Economic Stability and Consumer Confidence

The overall economic stability of a region plays a major role in real estate prices. In areas where the economy is stable, people are more likely to purchase homes and invest in real estate. Stability breeds consumer confidence, leading to more homebuyers entering the market. Conversely, in areas facing economic uncertainty or downturns, potential buyers may be hesitant to make a purchase. As real estate professionals know, economic stability creates a sense of security, which is essential for a healthy real estate market.

Interest Rates and Affordability

While not directly tied to the local economy, interest rates are influenced by broader economic factors and can significantly affect real estate prices. When interest rates are low, homes become more affordable for buyers, increasing demand and driving prices up. On the other hand, higher interest rates make borrowing more expensive, reducing the number of potential buyers and possibly causing real estate prices to decrease. Experienced real estate agents understand the effects of interest rates and how they can impact both the supply and demand for homes in a local market.

Infrastructure Development and Location

The development of local infrastructure, such as public transportation, roads, and schools, also affects real estate prices. Areas with improved infrastructure are more desirable to homebuyers, which can lead to an increase in property values. For example, the construction of a new highway or the expansion of a local transit system can make a previously less accessible area more appealing, thus increasing demand and prices. Top real estate agents in Camp Hill, PA, can help buyers understand how infrastructure projects in a neighborhood may impact the long-term value of a property.

Supply and Demand in the Local Market

Like any other market, real estate prices are driven by the basic principles of supply and demand. In areas with a high demand for homes and limited inventory, prices are likely to rise. Conversely, when there is an oversupply of homes for sale and fewer buyers, prices may stagnate or even decrease. Experienced realtors can help you navigate local market trends and make smart decisions about when to buy or sell based on the current supply and demand dynamics.

Let Us Help You Understand the Impact of the Local Economy on Your Home Search

At Smith Top Team Realtors, we understand how important the local economy is when considering real estate prices. Our team of local real estate agents in Camp Hill, PA, is here to provide you with valuable insights into how economic factors impact the market. Whether you’re looking to buy a home or sell your property, we can help you navigate local market trends and make informed decisions. Contact us to learn how we can help you understand the impact of the local economy on your real estate journey.