Navigating the world of property ownership can often feel like learning a new language, with real estate terms seeming like cryptic codes. That’s where Smith Top Team steps in, offering a lifeline in this sea of jargon.

This glossary isn’t just a list of definitions; it’s a tool designed to bridge the gap between confusion and clarity. Understanding these terms is crucial in making informed decisions, whether buying your first home or adding to your property portfolio.

Let’s demystify these terms, transforming daunting legal speak into clear, actionable knowledge. Welcome to your guide to real estate fluency, courtesy of Smith Top Team.

Glossary of Real Estate Terms: Decoding the Language of Homeownership

Navigating the world of real estate can often feel like learning a new language. That’s why we’ve compiled this essential glossary, brought to you by Smith Top Team, to help you decode the most common real estate terms. Let’s dive in and unravel the mysteries of real estate language together!

1. Appraisal

This is an evaluation to determine a property’s market value, typically conducted by a professional appraiser. It’s crucial in real estate as it affects how much a lender is willing to finance and ensures you’re paying a fair price for your home.

2. Closing Costs

These are the expenses, over and above the property price, incurred by buyers and sellers during the real estate transaction.

They can include title insurance, appraisal fees, and attorney fees. Knowledge of these costs is vital to avoid surprises at the closing table.

3. Contingency

Contingencies in real estate contracts must be met for the transaction to proceed. Common types include financing, home inspection, and appraisal contingencies. They offer a safety net, allowing you to back out under specific circumstances.

4. Equity

Equity is the portion of the property you truly “own.” It’s the difference between the home’s market value and the remaining mortgage balance. Understanding equity is important for homeowners considering selling or refinancing their home.

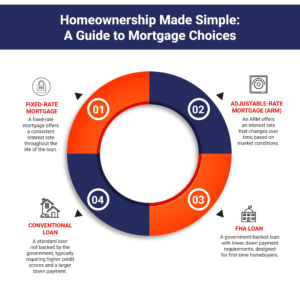

5. Fixed-rate vs. Adjustable-rate Mortgages

A fixed-rate mortgage has a constant interest rate throughout the loan term, while an adjustable-rate mortgage (ARM) has a rate that changes periodically. Each has pros and cons, and choosing the right one can significantly impact your financial future.

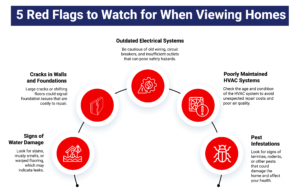

6. Home Inspection

This is a thorough examination of a property’s condition, usually performed by a professional inspector. It plays a crucial role in home buying, uncovering potential issues that could save you thousands in future repairs.

7. Listing

Listings are the way properties are advertised for sale. They come in different types – open, exclusive, and multiple – each with unique implications for buyers and sellers. Understanding these can streamline your home buying or selling process.

8. Mortgage Pre-approval vs. Pre-qualification

Pre-approval involves a more in-depth look at your finances and provides a more concrete loan offer, while pre-qualification is a quick assessment of your borrowing power. Pre-approval is often more valued by sellers in competitive markets.

9. Property Tax

The local government levied this tax on property based on its assessed value. It’s an ongoing homeowner cost and can vary significantly depending on location.

10. Title Insurance

This insurance protects against past property title defects, such as fraud or errors in public records. It’s a critical safeguard for your investment.

A 2023 study by the National Association of Realtors revealed that 40% of homebuyers find understanding the real estate process challenging. Don’t let complex terms be a barrier to your dream home. Turn to Smith Top Team for guidance and expertise in all things real estate. Your home journey is our mission.

Tips on Navigating Real Estate Language

Navigating the labyrinth of real estate terms can often feel like deciphering an ancient script. Each term, a cryptic symbol, represents a significant aspect of the property buying or selling journey.

But fear not, homeowners and prospective buyers, because mastering this language is your key to a smoother, more confident transaction. Here’s how you can effectively use the glossary and why it’s crucial to ask questions and seek clarification:

1. Understand the Context

Real estate terms often have different implications depending on the context. For instance, ‘contingency’ in an offer can mean something different than in a legal document.Use the glossary not just to understand the definition but also to comprehend the context in which a term is used.

2. Real-Life Application

When encountering a term in a document or conversation, refer to the glossary. It’s about more than just the definition; understand how it applies to your situation. This practical application of knowledge will deepen your understanding and confidence.

3. Ask Questions

Never ask your real estate agent or lawyer to clarify terms. According to a survey by the National Association of Realtors, over 70% of home buyers and sellers found the process confusing due to jargon and complex terminology.

The Smith Top Team, known for its clear communication and expertise, always encourages clients to ask questions. Your understanding is their top priority.

4. Seek Clarifications in Writing

Sometimes, verbal explanations can be forgotten or misunderstood. Whenever possible, ask for clarifications in writing. This helps in better understanding and provides a reference for future queries.

5. Empower Your Decision-Making

A clear understanding of real estate terms empowers you to make informed decisions. Whether it’s assessing the terms of a mortgage or understanding property taxes, knowledge is power.

6. Use the Glossary as a Negotiation Tool

Knowing your terms well can be a significant advantage in negotiations. It shows you’re informed and serious, potentially leading to more favorable outcomes.

Embark on Your Real Estate Journey: Connect with Smith Top Team Today

As we wrap up our journey through the labyrinth of real estate terms, remember this is just the beginning. For further guidance and personalized advice, don’t hesitate to visit Smith Top Team’s website. Our unique selling point is our commitment to you, offering a free consultation to address your specific real estate needs.

We’re here to turn your property dreams into reality, providing clarity and confidence every step of the way. Have questions or need more insights? Contact us for listing your properties for sale; we’re more than just a team –your partners in navigating the real estate landscape.